Who Pays British Columbia's Personal Income Tax: Analysis of the Most Recent Data

David Baxter, Andrew Ramlo, & Ryan Berlin

The Urban Futures Institute

I. Introduction

Much of the recent discussion of the incidence of personal income taxation has been in the context of the United States of America, fostered as it has been by the Occupy Wall Street movement and its focus on the top “one-percent” of income earners. Rather than borrowing conclusions from other jurisdictions, a better understanding of how incomes and personal income taxation are shared in British Columbia can be found in the most recently available data on personal income taxation by income groups in this and other Canadian provinces. In this vein, this paper presents an overview of the published data from the Canada Revenue Agency (CRA) on total assessed income from all sources and personal income taxes paid.

In doing so, there are a couple of data limitations that must be acknowledged. The first is that the most current data on level of income and taxation at the provincial level that has been released by the Canada Revenue Agency (CRA) is for the 2009 taxation year[1]. The second data limitation is that the data are published for income ranges, not for shares of the population, so it is not possible to directly address the top one percent of earners, or any particular percentage group. What can be addressed is, for example, the 21,420 people with assessed incomes of $250,000 or higher would have represented 0.56 percent of the adult population in BC in 2009, or the 187,320 people earning $100,000 and more would have represented 4.92 percent of the province’s 2009 adult population.

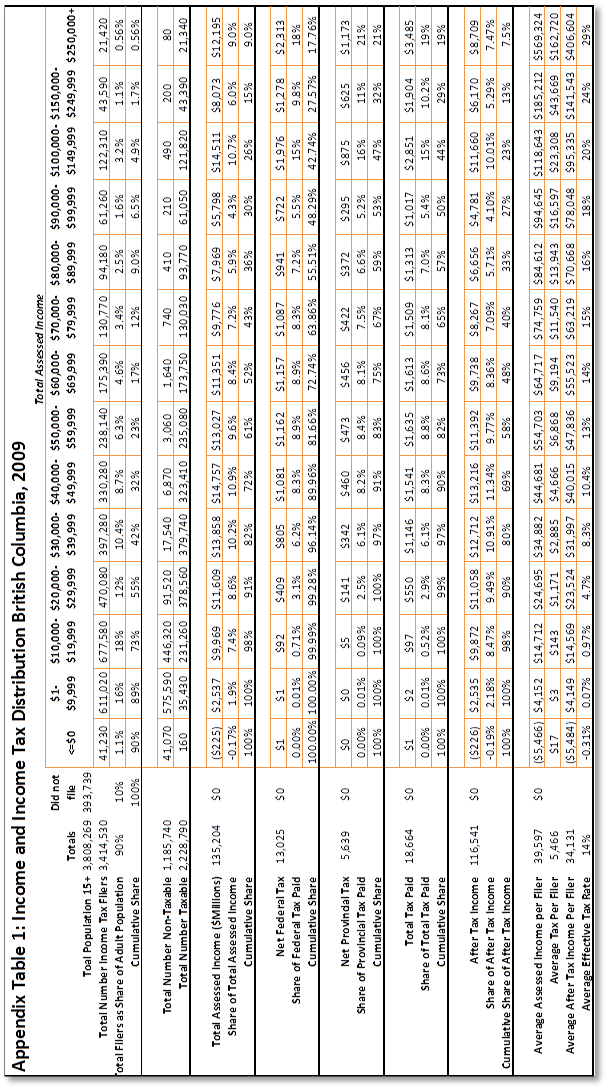

A summary of the taxation data for compressed income groups has been included on Table 1, with a more detailed tabulation included in the Appendix along with comparisons to selected provinces in Canada[2]. Note that the numbers below are presented to two decimal places, something necessitated by the small share of the total population in the highest income brackets and rounding significantly under- or over-stating their relative importance.

II. A Population Sharing Income Taxation

In 2009 there were an estimated 3,808,269[3] persons aged 15 plus in British Columbia. Of these 3.8 million, 89.7 percent, or 3,414,530 people, filed 2009 income tax forms, leaving an estimated 393,759 adults (10.34 percent of the population) who did not file income tax returns. Of the 3.4 million who did file, 1,185,740 were nontaxable returns (34.73 percent of tax filers) and 2,228,790 were taxable (65.27 percent of filers). This would imply that only 58.5 percent of the adults in British Columbia (2.23 million people) paid taxes in 2009 and 41.5 percent did not (1.58 million people). Of the 1.58 million who did not pay any taxes, 75.07 percent filed a tax form but did not pay taxes (31 percent of the adult population), and 24.92 percent (ten percent of the adult population) did not actually file a return.

With only 58.5 percent of the province’s adult population paying taxes, BC had the smallest share of taxpayers as a percentage of its adult population of the nine provinces: 63.6 percent of Alberta’s adults, 60.1 percent of Ontario’s and 67.3 percent of PEI’s adults paid income taxes in 2009. The nine provinces collectively saw an average of 60.9 percent of the adult population paying taxes. To some extent this variance may be explained by demographics (for example, Alberta has a relatively smaller older population) and to some extent by the degree that various provincial deduction, rebate and social services programs are tied to personal income tax filings.

So one interesting conclusion that emerges from the 2009 data is that, when compared to other provinces, the income taxes paid in BC (and hence received by the government) are borne by a smaller share of the province’s population than in other provinces in Canada, and in some cases a much smaller share (for example when compared to PEI).

Given how much attention has been paid to the high income earners, lets consider those who did pay personal income taxes and fell into the highest income bracket. In British Columbia in 2009, there were 21,420 people with assessed incomes of $250,000 or more. These 21,420 individuals represented 0.56 percent of the BC’s 3.8 million adults in 2009.

While accounting for under one percent of the province’s population, these people represented a much more than proportionate share of the province’s total assessed income in 2009. Of a total of $135.02 billion in assessed income, those earning$250,000 and over accounted for 9.02 percent ($12.20 billion), or 16 times their population share. The share of the personal income taxes paid by this group was even more disproportionate: of a total tax bill of $18.66 billion[4], those earning $250,000 and above paid $3.94 billion, or 18.68 percent of the total income tax bill, 33 times their population share (Figure 1, Table 1).

Broadening the definition of high-income earners to include everyone who earned $150,000 or more, Table 1 shows that these 65,010 people (21,420 plus 43,590) accounted for 1.71 percent of the adult population in BC (slightly above the one percent, but all that we can consider given the posted data). This group however represented 14.99 percent of the total assessed income ($20.27 billion) in the province in 2009, and for 28.88 percent of the total personal income taxes paid ($5.39 billion). Thus the 1.71 percent of BC’s adult population who were high income earners had an 8.9 times larger share of the total assessed income in the province and paid a 17.1 times larger share of the total income tax bill relative to their population share.

If we continue to cumulate the next income group, including all those with an assessed income of $100,000 or more in 2009, this group would have represented 187,320 people in 2009, or 4.92 percent of BC’s adult population. While these income earners represented roughly five percent of the provincial population, they accounted for a 25.72 percent share of total assessed income in the province in 2009 ($34.78 billion). Further, they paid 44.15 percent of total income taxes ($8.24 billion in 2009). Their share of total assessed income in the province was therefore 5.3 times their share of the provincial population, and their share of total income taxes paid was 9.1 times their population share.

While there is no clear definition of where high income ends, from a purely distributional perspective, it might be reasonable to include the top quarter of the population in this group, leaving the bottom quarter for low income, and the middle 50 percent as middle income. In 2009 this would have would put incomes of $50,000 to $99,999 in the high-income group in BC, even though such incomes may not seem very high to some. Using the range of assessed incomes of $50,000 and above as the high income group, the data show these individuals accounted for 23.11 percent of the adult population in BC, had 61.17 percent of the province’s assessed income ($82.70 billion), and paid 82.12 percent of the province’s personal income taxes ($15.33 billion).

What remains is the 17.88 percent of the personal income tax in the province (3.34 billion) that was paid by the 65.29 percent of BC’s adult population who had assessed incomes between $1.00 to $49,999 (39.00 percent of the assessed income in the province). While noting that people in this income group paid 17.88 percent of the personal income taxes, it is important to point out that of this group 46 percent (1,137,840 people) paid no income tax at all, and hence the tax contribution of this income group is from only slightly more than half of them.

There is a clear pattern in the data of an increasing share of total income taxes paid with increasing assessed incomes. This is reflective of a taxation system of higher average effective tax rates with increasing income. Effective tax rates for income groups are calculated as the total amount of tax paid by people in an income group as a percent of the group’s total assessed income: they result from a) increasing marginal tax rates with increasing income, b) basic deductions which exempt a greater portion of lower incomes from taxation; and c) the distribution of incomes within the income group.

Those in the $250,000 plus income group had an average effective tax rate of 28.58 percent of assessed income paid in personal income taxes ($3.49 billion in taxes paid divided by $12.20 billion in assessed income). This is more than twice the overall average effective tax rate of 13.80 percent in the province ($135.20 billion in assessed income and $18.66 billion in income taxes paid).

Those with assessed incomes in the $150,000 to $249,999 range paid an average effective tax rate of 23.58 percent, those in the $100,000 to $149,999 range paid 19.65 percent, and those in the $50,000 to $99,999 range paid an average effective tax rate of 14.79 percent. People with assessed incomes in the $1 to $49,999 range paid an effective tax rate of 6.33 percent, less than half the overall average of 13.08 percent.

III. Inter-provincial Comparisons

A comparison of British Columbia to other provinces shows that BC has a rather unusual personal income tax structure. In 2009 BC had the smallest share of the adult population who paid personal income taxes, 58.53 percent compared to a range of 60.53 to 67.06 percent that prevailed in other provinces. BC also had the lowest average effective income tax rate, 13.80 percent of the total assessed income in the province being paid as personal income taxes compares to a range of 14.20 to 17.20 percent in the other provinces. BC achieved this low tax rate status by having the lowest effective tax rate in every income group except the highest. The $250,000 plus group in BC had an effective rate of 28.58 percent rate, which was only narrowly beat out by Alberta at 27.94 percent.

Continuing the comparison with our nearest provincial neighbour highlights a couple of other interesting dimensions of BC’s personal income tax structure. While Alberta had a marginally lower average effective tax rate for its highest income earners, this group in Alberta paid a much larger share of its personal income tax bill. This group shouldered 25.82 percent of Alberta’s income tax bill versus 18.68 percent in BC. The reason for this is that high-income earners accounted for a much greater share of Alberta’s population, 1.21 percent or more than twice the 0.56 percent share in BC. Not only were there relatively more people in the highest income groups in Alberta, there were more people absolutely: Alberta had 36,470 people who earned $250,000 and over compared to only 21,420 in BC. This is in spite of Alberta having only four-fifths of BC’s population (3.02 million versus 3.81).

Every assessed income group $50,000 and above accounted for a greater share of the adult population in Alberta than in BC. Conversely, in British Columbia those with incomes under $50,000 accounted for a much larger share, 65.29 percent of the adult population in BC had incomes under $50,000 compared to 57.17 percent in Alberta. The result of the higher overall incomes in Alberta was that, effectively, higher income groups pay a greater share of the income taxes in Alberta than they do in BC, something that is reflected in Alberta having a higher average effective tax rate than BC (17.20 percent compared to 13.80 percent), and a larger overall share of people who pay taxes (63.30 percent in Alberta and 58.53 percent in BC).

Ontario also had a higher share of its population in this top income group, which accounted for 0.72 percent of its adult population in 2009. Compounding this greater share of high-income earners in Ontario was the sheer scale of this province’s population: 78,810 people had assessed incomes of $250,000, more than the 71,780 in all of the other eight provinces combined.

IV. Conclusions

This brief review of personal income taxation in British Columbia has been descriptive rather than normative, outlining the distribution of incomes and the incidence of personal income taxes in this province, and how the situation in BC differs from other provinces. As a summary, of the adult population in British Columbia in 2009:

- 59 percent paid 100 percent of the personal income taxes, while 31 percent filed income tax forms but did not pay taxes and 10 percent did not file;

- 65 percent had assessed incomes in the $1 to $49,999 range, accounted for 39 percent of total assessed incomes and paid 18 percent of the income taxes.

- 35 percent had assessed incomes of $50,000 and higher, accounted for 61 percent of total assessed incomes and paid 82 percent of the personal income taxes in the province;

- 5 percent had assessed incomes of $100,000 plus, accounted for 26 percent of assessed incomes, and paid 44 percent of the personal income tax;

- 1.7 percent had assessed incomes of $150,000 and above, accounted 14.99 percent of the assessed income in the province, and paid 28.88 percent of the personal income taxes; and,

- 0.56 percent (21,420 people), had assessed incomes of $250,000 or more, accounted for 9.02 percent share of assessed incomes, and paid 18.68 percent of the total income taxes.

Overall, British Columbia was found to have lowest average effective tax rate of all of Canada’s provinces (net of Quebec). This was the result of BC having the lowest average effective tax rate in all but the highest income groups (those with incomes of $250,000 and above).

From a provincial personal income tax perspective, it is important to note that the most recent taxation data show that the high income earners ($250,000 and above) in all provinces represent a relatively small proportion of each province’s adult population (from 0.22 percent in PEI to 1.21 percent in Alberta), they represent a significant share of both the total assessed income in each province and the total personal income taxes paid (from 27.94 in Alberta to 32.69 percent in Manitoba) and thereby received by government.

While much of the discussions in both the United States and Canada have focused on the normative aspects of the upper most one percent of income earners, considering the most recent taxation data for provinces in Canada allows a much better understanding of how incomes and personal income taxation are shared here in British Columbia and how we compare to our provincial counterparts.

V. Appendix

[1] As of May 18th, 2013. Final Statistics 2011 Edition (2009 tax year), www.cra-arc.gc.ca/gncy/stts/gb09/pst/fnl

[2] Quebec is not included in this comparison as CRA is not involved in administration of the provincial income taxation system in Quebec and hence does not tabulate its data.

[3] Statistics Canada. Cansim Table 051-0001 - Estimates of population, by age group and sex for July 1, Canada, provinces and territories, annual (persons unless otherwise noted).

[4] Combined federal and provincial personal income taxes.